Rent Coverage

Protect your rental income against defaults for up to the entire lease term.

Protect your rental income against defaults for up to the entire lease term.

Offer an affordable alternative to residents with damage protection you can trust.

Use our calculator to see how we can help you reach your financial goals and minimize debt, one unit at a time.

Our analytics are powered by machine learning to better inform decision making, and integrated with your property management system for streamlined workflow and heightened efficiency.

We use and provide machine learning to deliver fast results and reduce resident fraud.

Our large team of experts are there to support you from the very beginning, and will be by your side every step of the way.

TheGuarantors has become the choice for any operator looking to improve financial and operational performance while bringing great value to renters.

Adding the use of TheGuarantors' lease guarantees and security deposit replacements into our leasing program has helped us qualify more applicants and in turn has helped us fill our vacancies at a faster rate. Claims are processed and received quickly. Their customer service team is professional and prompt with their responses.

Because of TheGuarantors' products and exceptional service, we have been able to continually improve student conversions while exceeding leasing velocity goals and reducing bad debt.

TheGuarantors has been a crucial partner for achieving desirable lease velocity. After our success in New York, we extended our partnership to South Florida and are continuing with national expansion.

Rent Coverage is an insurance policy provided by TheGuarantors, with landlords as beneficiaries, that you purchase to qualify for leasing an apartment. This coverage reimburses landlords for missed rent or apartment damage, but it does not cover your monthly rent payments; you remain responsible for these. If you default and TheGuarantors pays on your behalf, you must repay those amounts to TheGuarantors. Your non-refundable payment to TheGuarantors is a premium for this coverage, ensuring you can secure the apartment you want. This fee is not a security deposit but can be used alongside one or with our Deposit Coverage product.

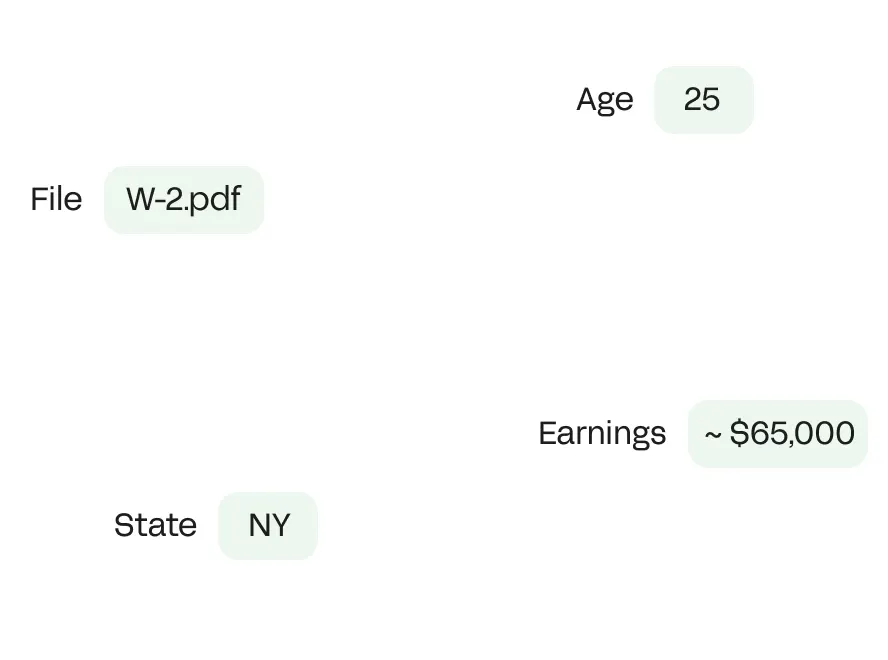

Renters do. The price is determined after underwriting in accordance with rates filed and approved by the regulators. Our Rent Coverage is a type of insurance policy that covers someone (the landlord) other than the person who buys it (the renter).

It’s easy. Contact us at moreinfo@theguarantors.com and we'll get you signed up. There is no cost or commitment. We can provide more hands-on training if you'd like, but that's up to you. We’ll be your dedicated partner every step of the way.

The policy covers the term of the lease, up to 36 months, depending on our filings in your state.